Developing prompt and trustworthy answers might be difficult s when unforeseen financial circumstances occur. Traditional bank loans aren't the best option when you need money quickly because they sometimes have stringent conditions, protracted approval processes, and waiting periods. This is where Fast Loan Advance and other Internet loan services are helpful.

Fast Loan Advance Reviews – What You Should Know Before Applying!

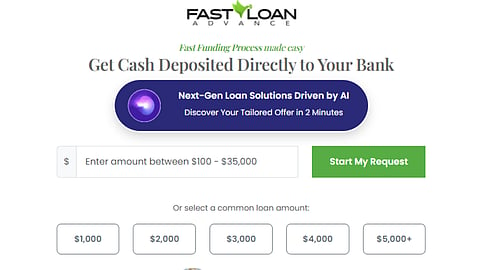

An online loan business called Fast Loan Advance was created to assist people in getting rapid cash when they most need it.

In this assessment, we will examine how Fast Loan Advance can offer a quicker, easier, and more adaptable method of obtaining money. This network provides a swift link to you with possible lenders, even if your credit isn't great, whether you need a short-term loan or are struggling with urgent costs.

We'll review the main characteristics of Fast Loan Advance, the application procedure, and the range of loan amounts that are available. We'll also discuss the advantages of using this service, the platform's validity and safety, and whether it's a worthy option for borrowers in need of quick cash. At the end of this study, you'll know precisely how Fast Loan Advance operates and whether it's the best choice for your financial requirements.

Fast Loan Advance - What Is This And What Does It Do?

An online loan business called Fast Loan Advance was created to assist people in getting rapid cash when they most need it. This site links borrowers with possible lenders in a few easy steps, whether they're dealing with an unforeseen debt, an emergency, or just need additional money until their next paycheck.

Fast Loan Advance is a more practical option than typical bank loans, which require extensive documentation and credit checks. Its user-friendly online loan application procedure allows consumers to seek a loan from the comfort of their home and get an answer in minutes. Due to its ability to adapt to various financial circumstances, the platform is a fantastic choice for people who might find it difficult to obtain bank loans because of poor credit.

Several Fast Loan Advance reviews emphasize the platform's effectiveness in connecting consumers with lenders that provide flexible repayment terms. Loan amounts may differ according to eligibility, but the procedure is still quick and easy, guaranteeing that those accepted get their money as soon as possible.

How Does Fast Loan Advance Work? - Fast Loan Advance Reviews

Fast Loan Advance aims to deliver prompt financial aid through an easy online method. In contrast to traditional banks, which have lengthy approval processes and a lot of paperwork, our service provides a simple method to get money when you need it most.

It begins with a simple application. Users may access the Fast Loan Advance online platform and complete a brief form with their personal information, such as their needed loan amount and income. Even applicants with less-than-perfect credit have a better chance of being approved since the platform links borrowers with a network of lenders.

One of this service's greatest benefits is that it offers Fast Loan Advances without a credit check. While credit scores are a significant determinant of eligibility for many traditional lenders, this platform gives more weight to other considerations like income and repayment capacity. This makes it a perfect choice for people whose terrible credit may have prevented them from obtaining loans elsewhere.

Fast Loan Advance reviews highlight its fast funding process, with approved loans typically deposited within 24 hours. Once terms are accepted, funds go directly into the borrower라이브 바카라 account. Its quick, hassle-free system makes it a reliable solution for urgent financial needs.

How Do You Apply For A Fast Loan Advance Loan?

1. Fill Out the Online Application Form

Start by going to the web platform for Fast Loan Advance. You will be required to submit basic information such as your name, contact details, income, and the amount of the loan that you require. Completing the application form takes just a few minutes and is easy to use.

2. Get Matched with a Lender

Following your application submission, the system will promptly review your information and pair you with lenders who are prepared to make a loan offer based on your financial circumstances. According to evaluations, unlike traditional banks, Fast Loan Advance does not demand a flawless credit score, which makes it simpler for many customers to apply.

3. Review Loan Offers and Terms

Once you have been paired with a lender, you will receive loan proposals with information on interest rates, repayment periods, and loan amounts. Before accepting an offer, carefully read the conditions to ensure it meets your needs.

4. Receive Your Funds

When you accept a loan offer, the lender handles the transaction, and the money is sent straight into your bank account, sometimes in less than a day. Acquiring the cash you need with a Fast Loan Advance online is easy and quick.

Fast Loan Advance No Credit Check – Does Fast Loan Advance Check Your Credit Score?

One of the most important questions for borrowers is whether their credit score will impact their lending prospects. Fast Loan Advance online is a far more flexible method compared to traditional lending organizations. People with low or bad credit histories who want immediate financial assistance are the target audience for this site.

One of this service's main advantages is offering Fast Loan Advance choices without a credit check. While banks place great emphasis on credit ratings, Fast Loan Advance links clients with lenders who consider other aspects, including income and repayment capacity. People with Fast Loan Advance terrible credit can now obtain a loan more easily without worrying about prior financial errors.

Fast Loan Advance offers a simple online application process, connecting borrowers with lenders based on financial circumstances, not credit history. This boosts approval chances without delays. With no rigorous credit checks, it's an excellent option for those needing urgent cash.

Is Fast Loan Advance Interest Rate Reasonable? – Can You Afford The Fast Loan Advance Interest Rate?

One of the main questions when applying for a loan online is whether the interest rate is reasonable. Compared to many other online lending businesses, Fast Lending Advance offers reasonable rates that are frequently lower for consumers.As a result, it's a fantastic choice for people who need money quickly without worrying about exorbitant payback fees.

The fairness and transparency of the Fast Loan Advance interest rate are intended to make sure that borrowers are aware of the conditions before agreeing to a loan. Rapid Loan Advance online links consumers with trustworthy lending partners who provide affordable rates depending on the borrower's financial profile, unlike specific lenders who impose exorbitant costs. This implies that exploitative interest rates won't prevent you from accessing cash even if your credit score isn't flawless.

Fast Loan Advance stands out for its flexibility, affordability, and quick approvals, making it a reliable option for urgent financial needs. With fair rates and instant access to funds, it's a top choice for borrowers.

How To Qualify For A Loan From Fast Loan Advance Online?

Be at Least 18 Years Old

You must be a legal adult to apply for a Fast Loan Advance. According to lenders, applicants must be at least eighteen years old to be eligible.

Have a Stable Source of Income

You must demonstrate that you have a consistent source of income, even if Fast Loan Advance does not need excellent credit. Employment, self-employment, or government benefits can all provide this. This is how lenders assess your capacity to pay back the loan.

Provide a Valid Checking Account

Since the loan money is put straight into your bank account, you must have a functional one. Thanks to this, lenders can also establish a simple repayment procedure.

Be a U.S. Citizen or Permanent Resident

Being a lawful resident of the United States is a requirement for applying for a Fast Loan Advance online. Certain lenders may also require proof of residence, such as a utility bill.

How Fast Can You Get A Loan From Fast Loan Advance Online?

One of the main benefits of Fast Loan Advance online is the ability to get your money quickly. This business provides an alternative to traditional banks that handle loan applications in days or even weeks.

After completing the easy online application, your request is promptly examined and may be approved in minutes. Since many customers claim to have received their loan approval immediately, it's a fantastic choice for those with pressing financial demands. The monies are typically transferred to your bank account within 24 hours after approval; depending on your bank's processing delays, this may happen on the same day.

Fast Loan Advance ensures that you receive financial support without needless delays, whether you need it for bills, emergencies, or unforeseen needs. For people who want urgent cash without the lengthy wait times associated with traditional lenders, this is the best option because of its quick and easy method.

When Can Fast Loan Advance Come In Handy? – When Can You Get Help From Fast Loan Online?

Emergency Medical Bills –

Expenses for unexpected medical care may be stressful, particularly if you lack funds or insurance. Fast Loan Advance offers immediate cash for urgent medical care, prescription drugs, or hospital costs.

Urgent Car Repairs –

If your automobile breaks down and you need it for work or everyday chores, you might be unable to wait for your next paycheck. Fixing your car immediately may avoid more hassle. Fast Loan Advance.

Paying Overdue Bills –

Eviction notices, fines, and disconnections may result from late rent or utility payments. You may prevent additional costs or delays by paying your debts on time with a fast cash loan advance.

Unexpected Travel Expenses –

There are occasions when last-minute job trips or family emergencies require last-minute travel arrangements. With Fast Loan Advance, you may immediately pay for your tickets, lodging, and other travel expenses.

Bridging Financial Gaps –

If you need money for food, school fees, or other necessities until your next paycheck arrives, Fast Loan Advance online offers a simple solution.

Is Fast Loan Advance Legit? – Key Facts You Need to Know!

Many individuals ask, "Is Fast Loan Advance legit?" while searching for a quick loan. Picking a reliable business is crucial because so many online lenders are available. According to many Fast Loan Advance reviews, this platform is a valid and trustworthy means of obtaining immediate financial aid without needless complications.

Fast Loan Advance provides a clear procedure that guarantees borrowers are aware of the loan conditions before making a commitment. This service has explicit terms and conditions, unlike scammers that hide additional costs or require upfront payments. Consumers who have asked for a rapid cash loan advance attest that the service can fulfill its claims by reporting seamless transactions and prompt money transfers.

Fast Loan Advance offers accessible online lending, even for those with poor credit, by connecting borrowers with trustworthy lenders. It provides a quick, secure financial solution, but reviewing terms before borrowing is essential. User reviews and transparent policies confirm its reliability for obtaining fast, hassle-free loans.

Who Do We Not Recommend Fast Loan Advance Online For – When To Not Get Online Loans

Although fast online loan advances can be helpful in many cases, there are some scenarios in which this service might not be ideal. In the following four circumstances, you ought to think twice before applying for this loan:

If You Have a Stable, Long-Term Financial Plan –

You might not need a quick loan advance if you depend on a steady monthly income or have adequate funds to meet unforeseen costs. It's preferable to spend your funds rather than incur further debt.

If You Can't Afford to Repay the Loan –

A rapid cash loan advance might put you under additional financial burden later because of hefty interest rates or late penalties if you're not confident you can repay the loan. Apply only if you know you can make the loan payments on schedule.

If You Have a Poor Credit History –

Even if Fast Loan Advance is open to individuals with poor credit, those with severe credit problems could still be subject to higher interest rates or unfavorable loan conditions. If you cannot negotiate a decent price, look for other options.

If You're Looking for Large Loan Amounts –

If your financial needs—such as substantial debt consolidation or long-term investments—are greater than what Fast Loan Advance can offer, larger, more structured loans from traditional lenders are preferable.

Do We Recommend Trying Fast Loan Advance? – Our Final Verdict On Fast Loan Advance Reviews

Considering every aspect of Fast Loan Advance, we can confidently state that it is a good choice for people who require immediate financial support. This business is unique because of its easy-to-use web platform, quick approval procedure, and flexibility—especially for individuals with poor credit or in dire need of money. The capacity of Fast Loan Advance to swiftly and effectively match applicants with qualified lenders is often reflected in favorable evaluations.

The platform offers a range of loan amounts, from minor emergency money to larger quantities for critical requirements, and the application procedure is straightforward. A cheaper choice for many consumers, the rapid loan advance interest rate is also very low compared to other online lenders.

Fast Loan Advances are ideal for short-term financial needs, not long-term solutions. If you can repay on time, they provide quick access to funds. We recommend them for urgent situations, but always review terms and ensure you can meet repayment obligations.

FAQs For Fast Loan Advance Review - Fast Loan Advance Reviews

1. Is Fast Loan Advance available for people with bad credit?

Fast Loan Advance does really provide loans to borrowers with poor credit. They give people who would struggle to qualify for conventional loans an alternative.

2. How long does it take to get approved for a loan?

Approval usually happens quickly; many candidates who use the fast loan advance online platform receive their conclusions minutes after submitting their applications.

3. Can I apply for a loan without a credit check?

Indeed, there is no credit check for a Fast Loan Advance, so even those with subpar credit ratings can use it.

Disclaimer: This is a sponsored article. All possible measures have been taken to ensure accuracy, reliability, timeliness and authenticity of the information; however 바카라india.com does not take any liability for the same. Using of any information provided in the article is solely at the viewers’ discretion.